who pays sales tax when selling a car privately in illinois

Illinois Sales Tax on Car Purchases. However you do not pay that tax to the car dealer or individual selling the car.

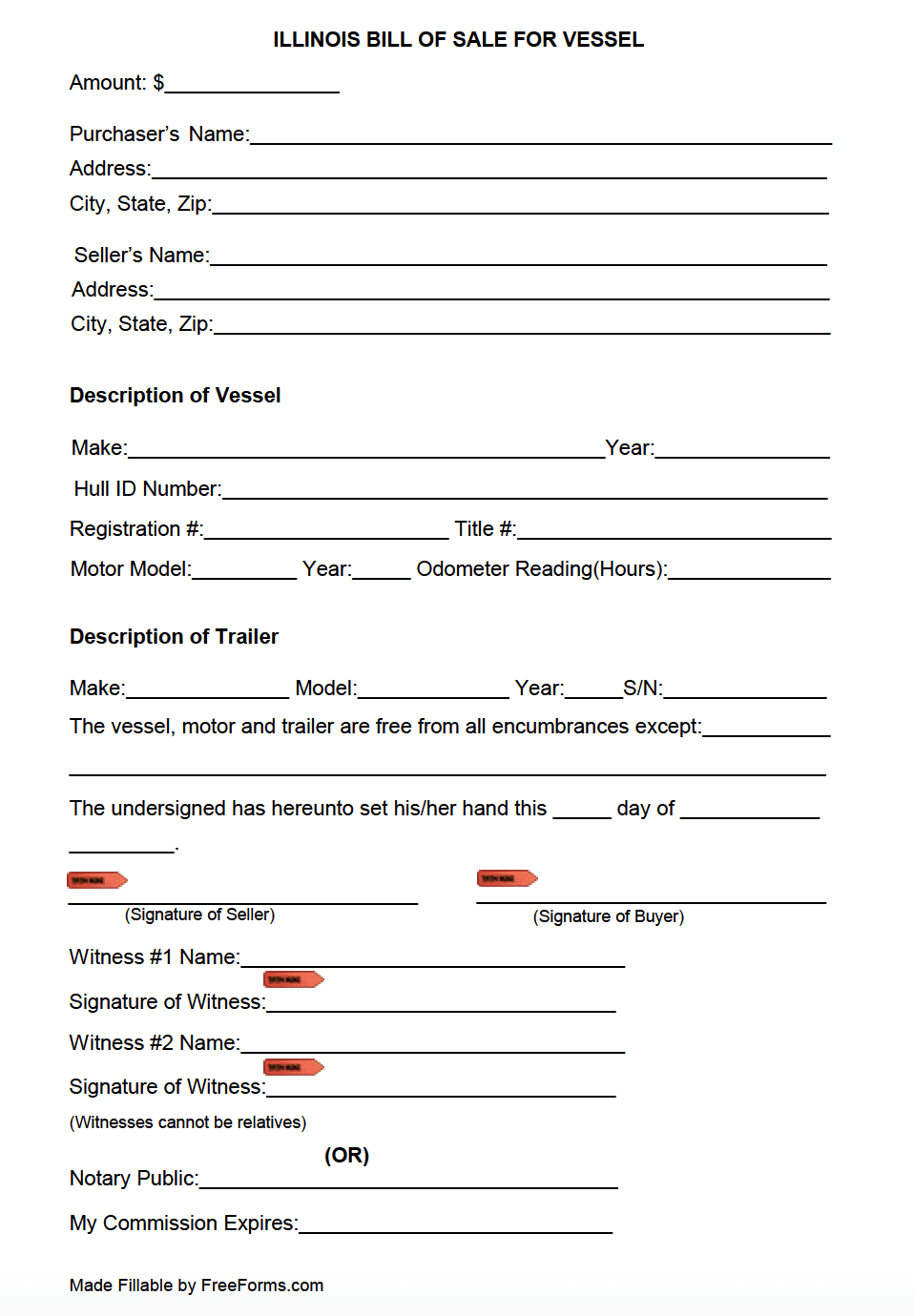

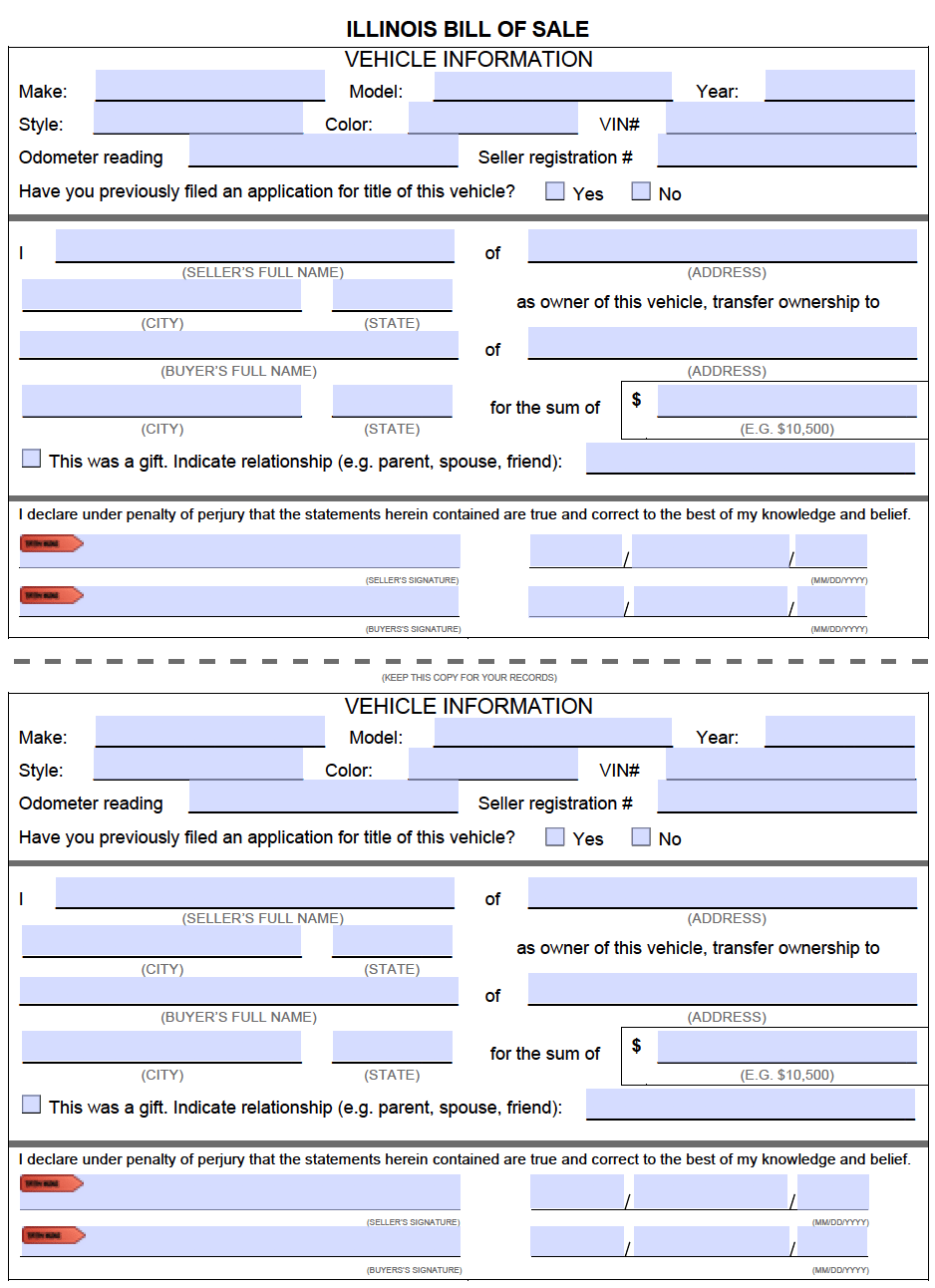

Free Illinois Bill Of Sale Forms Pdf

Who pays sales tax when selling a car privately in illinois.

. There is also between a 025 and 075 when it comes to county tax. WHEN SELLING YOUR CAR Reporting a wrong purchase price is FRAUD. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale.

Steps To Take When Selling A Car In Illinois - Cash Cars Buyer. It starts at 390 for. Use the illinois tax rate finder to find your tax.

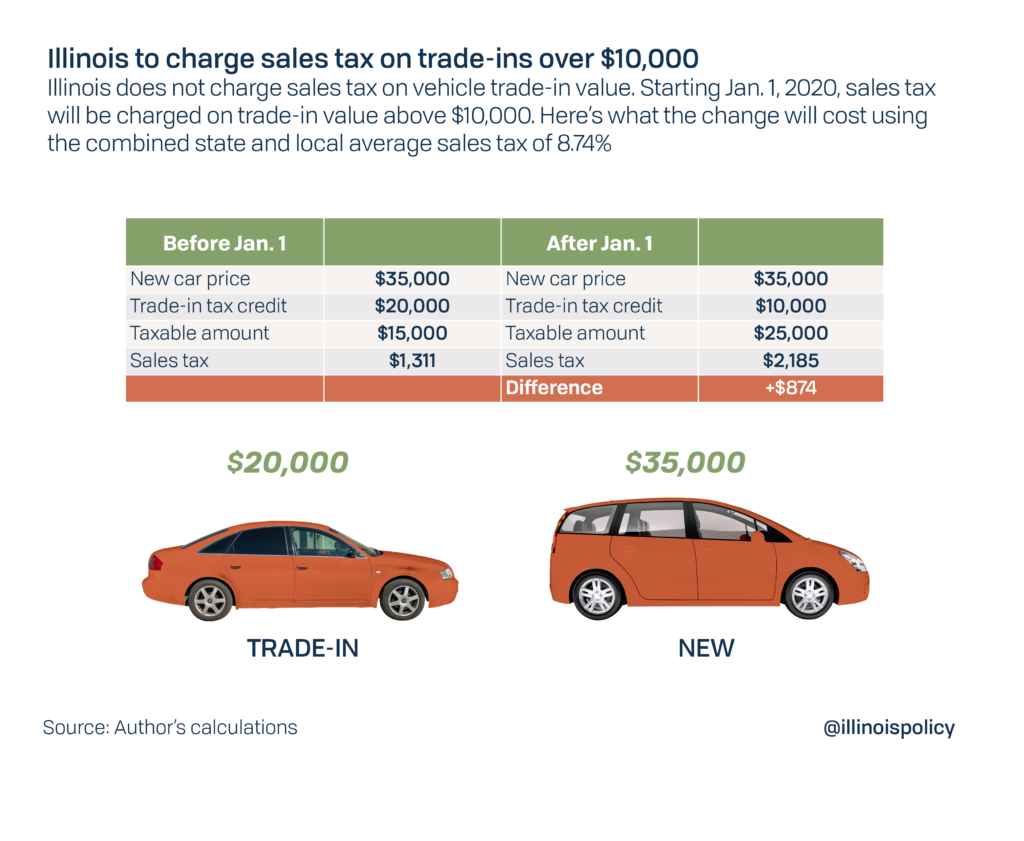

You will subtract the trade-in value by the purchase price and get 25000. For vehicles worth less than 15000 the tax is based on the age of the vehicle. Illinois collects a 725 state sales tax rate on the purchase of all vehicles.

As of January 1st 2022 Illinois. However a bill of sale can be a helpful document. Arkansas House Bill would decrease car sales tax on.

Form ST-556 Sales Tax Transaction. The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue. Saying a SALE is a GIFT is FRAUD.

Form RUT-50 Private Party Vehicle Use Tax Transaction Return due no later than 30 days after the purchase date of the vehicle. How is sales tax calculated on a used car in Illinois. Illinois collects a 725 state sales tax rate on the purchase of all vehicles.

There is also between a 025 and 075 when it. A title is required to register a motor vehicle. Illinois Sales Tax on Car Purchases.

In addition to state and county tax the City of. When you sell your car you must declare the actual selling purchase price. Therefore your car sales tax will be based on the 25000 amount.

What is the state sales tax on cars in Illinois. Safety Administrations NHTSA odometer disclosure. Who pays sales tax when selling a car privately in Illinois.

The state where you pay vehicle registration fees is the one that charges the sales tax not the state where you made the vehicle. The buyer will have to pay. There is also between a 025 and 075 when it comes to county.

This tax is paid directly to the Illinois Department. This tax is paid directly to illinois department of revenue. Illinois collects a 725 state sales tax rate on.

If you are selling a car in illinois you must follow the following steps. Illinois collects a 725 state sales tax rate on the purchase of all vehicles. Although the buyer pays for this inspection the seller and buyer must agree on when and where the inspection is to be held.

It ends with 25 for vehicles at least 11 years old. If you buy a car in New Jersey then youll need to pay sales tax and other fees when you transfer ownership. Illinois collects a 725 state sales tax rate on the purchase of all vehicles.

Sales taxes in Illinois are calculated.

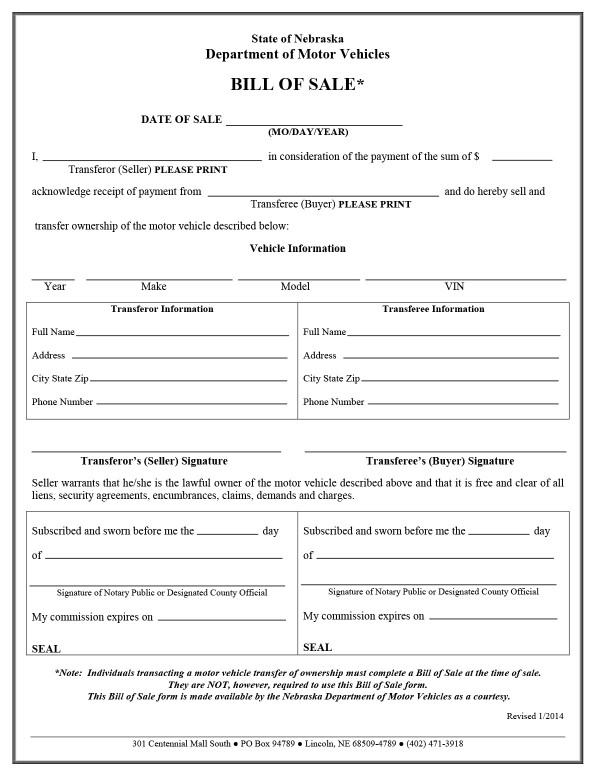

All About Bills Of Sale In Nebraska The Forms And Facts You Need

How To Pay Illinois Sales Tax Online 9 Steps With Pictures

Illinois Sales Tax Irv2 Forums

8 Tips For Buying A Car Out Of State Carfax

How To Pay Illinois Sales Tax Online 9 Steps With Pictures

Free Illinois Bill Of Sale Forms Pdf

What Paperwork Do I Need To Sell My Car In Illinois Sell My Car In Chicago

Free Bill Of Sale Forms 24 Word Pdf Eforms

Free Illinois Motor Vehicle Bill Of Sale Form Word Pdf Eforms

What Paperwork Do I Need To Sell My Car In Illinois Sell My Car In Chicago

Buying From A Private Seller Vehicle Registration Titling And Fees Explained

Free Bill Of Sale Forms 24 Word Pdf Eforms

Texas Car Sales Tax The Ultimate Guide

Illinois Car Trade In Tax Changes Starting January 2020 Honda City Chicago

How To Close A Private Car Sale Edmunds

Illinois Imposing Car Trade In Tax On Jan 1 Dealers Call It Double Taxation

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Trade In Value New Illinois Law Removes Tax Credit Cap For Trading In Vehicle When Buying A New Car Abc7 Chicago